The ‘People’s Assembly’ of Crete voted against the Strategic Environmental Study (SES) for the new Special Spatial Framework for Tourism: Local Opposition to Tourism Development Plan.

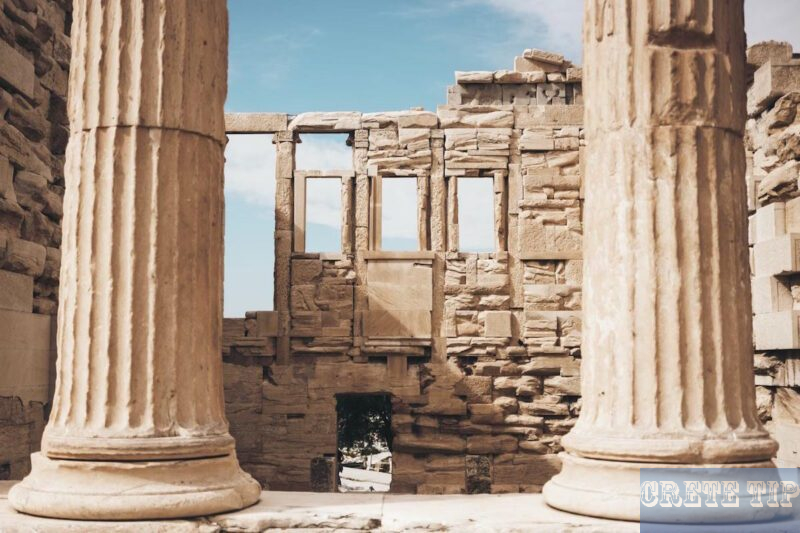

Landscape of Tourism Development in Crete

The tourism industry in Crete has undergone significant changes in recent years, with new policies and frameworks shaping its growth. These developments have sparked debates about the direction and impact of tourism on the island.

A key issue is the uneven representation in discussions about tourism planning. Large hotel owners often have a seat at the table, while smaller businesses and workers in the hospitality sector are left out. This imbalance raises questions about whose interests are being prioritised in policy decisions.

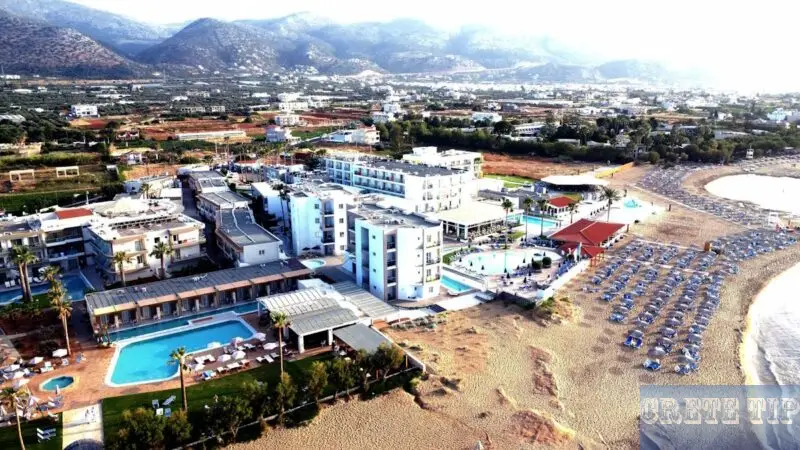

The current tourism strategy appears to favour large-scale developments:

- Massive hotel complexes

- Thousands of new tourist beds

- Focus on high-end, luxury accommodations

While these projects aim to boost the economy, they have also created tensions within local communities. Some argue that this approach primarily benefits a small group of wealthy investors rather than the broader population of Crete.

The impact on workers in the tourism sector is a particular concern. Despite the industry’s growth, many employees face:

- Challenging working conditions

- Erosion of labour rights

- Struggle to make ends meet

This has led some to question whether the so-called “tourism miracle” is truly benefiting the average Cretan.

The contrast between the gleaming new resorts and ongoing hardships in some areas is stark. For instance, in Arkalochori, many residents affected by a recent earthquake:

- Still live in temporary container housing

- Struggle to rebuild their lives

- Include tourism workers and their families

This situation highlights the uneven distribution of tourism’s economic benefits across the island.

Environmental concerns are also at the forefront of discussions about Crete’s tourism development. The environmental impact of large-scale projects on the island’s delicate ecosystems must be carefully considered.

As Crete moves forward, finding a balance between economic growth, environmental protection, and social equity remains a significant challenge. The debate over the island’s tourism strategy is likely to continue as stakeholders grapple with these complex issues.

Greece Boasts Substantial Tourist Accommodation Capacity

Greece stands out as a major player in the European Union’s tourism sector, ranking sixth in bed capacity. In 2023, the country offered more than 1.2 million tourist beds, contributing significantly to the EU’s total of 29.2 million. This impressive figure represents 4.2% of the EU’s overall accommodation capacity.

The Greek tourism industry’s strength is evident when compared to other EU nations. While Greece holds a respectable position, it’s worth noting the countries that surpass it:

- Italy

- France

- Spain

- Germany

- Netherlands

Italy and France dominate the EU’s tourist accommodation landscape. Together, these two nations account for just over one-third of the total capacity. Italy leads with 5.2 million beds, representing 18% of the EU total. France follows closely with 5.1 million beds, or 17% of the EU’s capacity.

To better understand Greece’s position, let’s examine the numbers:

Country |

Number of Beds |

Percentage of EU Total |

|---|---|---|

Italy |

5.2 million |

18% |

France |

5.1 million |

17% |

Greece |

1.2+ million |

4.2% |

Greece’s robust accommodation capacity reflects its status as a popular tourist destination. The country’s ability to host such a large number of visitors speaks to its well-developed tourism infrastructure and its importance in the European travel industry.

This substantial bed capacity allows Greece to cater to various types of travellers, from budget-conscious backpackers to luxury-seeking holidaymakers. The range of accommodation options includes:

- Hotels and resorts

- Guesthouses and bed and breakfasts

- Holiday apartments and villas

- Campsites and hostels

The diversity in accommodation types helps Greece appeal to a wide array of tourists, contributing to its competitive edge in the European market.

Greece’s position in the EU tourist accommodation ranking underscores its commitment to the tourism sector. This commitment is crucial, as tourism plays a vital role in the Greek economy. The country’s investment in accommodation infrastructure supports job creation, stimulates local economies, and attracts foreign currency.

As the tourism industry continues to evolve, Greece’s substantial bed capacity positions it well to adapt to changing travel trends and visitor preferences. This flexibility could prove invaluable in maintaining and potentially improving its standing among EU tourist destinations.

Tourism Boom on Crete

The Greek island of Crete has experienced a remarkable surge in tourism during 2024. This picturesque Mediterranean destination has seen a significant increase in both air and sea arrivals, solidifying its position as a prime holiday spot.

In the first nine months of 2024, Crete welcomed 4.8 million international air arrivals, marking a 6.5% increase compared to the same period in 2023. This growth is part of a broader trend across Greece, which saw a total of 22.6 million international air arrivals from January to September, surpassing the previous year’s figures by 7.9%.

The influx of visitors to Crete began early in the year, with a strong start in the first quarter. January 2024 alone recorded 485,000 international arrivals, representing a substantial 25.3% increase. This momentum continued into the second quarter, albeit at a more moderate pace.

Here’s a breakdown of international air arrivals in Greece by month:

Month |

Arrivals (millions) |

Year-on-Year Increase |

|---|---|---|

April |

1.4 |

5.6% |

May |

2.9 |

12.7% |

June |

3.8 |

5.6% |

July |

4.6 |

5.3% |

August |

4.5 |

7.4% |

September |

3.7 |

7.1% |

Crete’s popularity among travellers is evident when compared to other Greek regions. While the Cyclades islands experienced a slight decline of 0.8%, Crete’s 6.5% growth in air arrivals was impressive. Other regions also saw increases:

- Dodecanese: 9.7% increase, with 4 million arrivals

- Ionian Islands: 4.9% increase

- Peloponnese: 11.8% increase

The tourism boom extends beyond air travel. Greece as a whole recorded 10.3 million international sea and road arrivals from January to September 2024, a substantial 14.5% increase from the 9 million arrivals in the same period of 2023. September alone saw 1.5 million road arrivals, marking a 17.5% rise.

This surge in tourism has had a significant impact on Crete’s economy and infrastructure. The island has been working to accommodate the growing number of visitors, with investments in hotels and tourist facilities. Many of these developments focus on luxury offerings, as Crete aims to attract high-end travellers.

The tourism industry on Crete has adapted to meet the demands of this influx. Local businesses, from restaurants to tour operators, have expanded their services to cater to the diverse needs of international guests. This has led to job creation and economic growth across the island.

However, the rapid increase in tourism also presents challenges. Infrastructure strain, particularly on water resources and waste management systems, has become a concern. Local authorities are working to address these issues to ensure sustainable growth in the sector.

Environmental conservation efforts have gained importance as well. Crete’s natural beauty is a major draw for tourists, and preserving its landscapes and ecosystems is crucial for long-term tourism success. Initiatives promoting eco-friendly tourism practices are being implemented across the island.

The cultural impact of this tourism boom is notable. While it brings economic benefits, there’s also a focus on preserving Cretan traditions and authenticity. Local communities are finding ways to share their heritage with visitors while maintaining their unique identity.

Transportation on the island has seen improvements to handle the increased tourist numbers. Upgrades to airports, roads, and public transport systems have been necessary to ensure smooth travel experiences for both visitors and residents.

Despite the overall positive trend in visitor numbers, it’s worth noting that the increase in arrivals hasn’t been directly matched by a proportional rise in tourism revenue. This suggests a shift in spending patterns among visitors, possibly due to changes in travel habits or economic factors in tourists’ home countries.

The tourism sector on Crete is also adapting to changing travel preferences. There’s a growing interest in experiential tourism, with visitors seeking authentic local experiences rather than traditional package holidays. This has led to the development of new tourism products focusing on Cretan cuisine, traditional crafts, and cultural immersion.

Digital technology plays an increasingly important role in Crete’s tourism industry. From online booking platforms to virtual tours, the island’s tourism stakeholders are embracing digital solutions to enhance visitor experiences and streamline operations.

Seasonal variations in tourism remain a challenge. While summer months see peak visitor numbers, efforts are being made to promote Crete as a year-round destination. Winter tourism initiatives, highlighting the island’s mild climate and cultural offerings, are being developed to balance the tourism flow throughout the year.

The impact of this tourism boom extends beyond the hospitality sector. Real estate on Crete has seen increased interest from international buyers, both for holiday homes and investment properties. This has led to changes in the local property market and community dynamics.

Crete’s tourism industry is also focusing on diversification. While beach tourism remains popular, there’s a growing emphasis on other forms of tourism such as agrotourism, wellness retreats, and adventure sports. This strategy aims to appeal to a broader range of travellers and reduce dependence on any single market segment.

The island’s tourism stakeholders are keenly aware of the need for sustainable growth. Efforts are being made to balance economic benefits with environmental and social considerations. This includes promoting responsible tourism practices and investing in green technologies.

Greek holidaymaker numbers rise as income dips

Greece saw an unexpected twist in its tourism sector this August. While more visitors flocked to the country, the money they spent decreased. The Bank of Greece reported that travel income fell by 1.8% compared to August 2023. This drop occurred despite a 6.6% increase in tourist arrivals.

Greek tourism revenue dropped to €4.249 billion in August 2024, down from €4.328 billion the previous year. This trend followed a similar pattern observed in July.

Looking at the broader picture, the January to August period showed some positive signs:

- Total tourism revenue: €15.179 billion

- Increase from 2023: 3.2%

- Rise in non-resident travellers: 9.9%

Common Queries About the Cretan Assembly’s Decision

How Might the People’s Assembly Vote Impact Cretan Tourism?

The vote against the Strategic Environmental Study could affect tourism planning in Crete. It may lead to:

- Delays in new tourism development projects

- Reconsideration of current tourism strategies

- Potential shifts towards more sustainable tourism models

Tourism stakeholders may need to adapt their plans in light of this decision.

What Effects Does the Environmental Study Decision Have on Cretan Development?

The rejection of the Strategic Environmental Study may:

- Slow down approval processes for new developments

- Require revisions to existing development proposals

- Encourage a more thorough examination of environmental impacts

Developers might need to reassess their plans to align with environmental concerns.

Potential Environmental Policy Changes Following the SES Rejection

The vote could lead to:

- Stricter environmental regulations

- More emphasis on conservation in future policies

- Increased public involvement in environmental decision-making

Local authorities may need to revise their approach to environmental management.

Key Concerns Regarding the Tourism Spatial Framework

The People’s Assembly likely worried about:

- Over-development of natural areas

- Strain on local resources and infrastructure

- Preservation of Cretan culture and heritage

- Long-term sustainability of the tourism sector

These issues may shape future discussions on tourism planning.

Next Steps After the Assembly’s SES Decision

Possible actions include:

- Revising the Strategic Environmental Study

- Conducting additional public consultations

- Exploring alternative tourism development models

- Seeking expert opinions on sustainable practices

Alignment with Crete’s Economic and Environmental Vision

The vote suggests:

- A strong focus on environmental protection

- Desire for balanced economic growth

- Emphasis on preserving Cretan identity

- Push for more sustainable development practices

This decision may reflect a broader shift in Crete’s approach to balancing tourism, economy, and environment.