Rising flight arrivals, but up to a 40% decline in retail and restaurant sales, only 50% hotel occupancy, and the dispute with Airbnb.

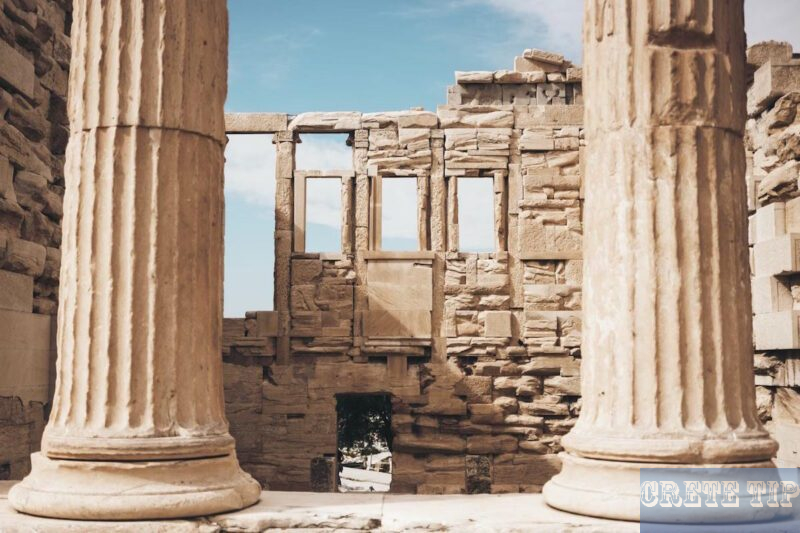

Crete still pulls in big crowds, especially in hotspots like Chania and Lasithi. The Palace of Knossos, Archaeological Museum of Heraklion, Samaria Gorge, the Venetian harbour, and the palm forest—these are the go-to stops for most visitors, especially the French and Polish.

But here’s the thing: even with hotels full and tourist sites buzzing, most people seem glued to their accommodation. They’re not really out and about, splurging in town like they used to.

This trend of sticking close to the hotel means shops and restaurants are feeling the pinch. Sales are down, even though the island looks packed, and the mood among business owners is… not great.

People are watching their wallets, cutting back on shopping and meals out, and honestly, who can blame them with prices up everywhere in Europe?

Significant Financial Challenge in Europe

Europe’s dealing with a rough economic patch, and tourism is definitely feeling it. Sure, more people are traveling to certain places, but that doesn’t mean they’re spending more.

Travelers are cutting their trips short, watching every euro, and it’s obvious in the numbers. Businesses relying on tourism just aren’t seeing the cash flow they’d hoped for.

Everyone’s looking for ways to save. Shorter holidays, fewer dinners out, less shopping, and—no surprise—cheaper places to stay are all part of the new normal.

It’s a cautious approach, with folks really feeling the squeeze of tight budgets this year.

Factors Affecting Tourism Spending |

Impact on European Tourism Economy |

|---|---|

Increased tourist arrivals |

Does not always mean more revenue |

Reduced overnight stays |

Lower total money spent per visitor |

Cost-cutting by travellers |

Less spending on dining, shopping, and trips |

Broader economic pressures |

Limits disposable income for travel expenses |

All this is made worse by bigger economic problems—wars, inflation, you name it. People are paying more for basics, so there’s less left for vacations.

Hotels, restaurants, shops—they’re all feeling the strain. Cruise tourism, which once seemed like a silver lining, isn’t immune either.

Even when ships dock and crowds pour in, cruise passengers tend to spend as little as possible. Local businesses barely get a slice of the pie.

Tourism providers now have to hustle harder, offering deals and discounts just to get people through the door. It’s a tough game, and no one’s sure how long they can keep it up.

Factor |

Impact on Retail Revenue |

|---|---|

Economic environment |

High cost pressures, lower demand |

Unequal EU fund access |

Benefits few large businesses |

Tourism fluctuations |

Variable income in tourist areas |

Infrastructure quality |

Affects regional retail success |

20-25% Decline in Retail Revenues in 2025

Retailers are really hurting this year. Most have seen sales drop by 20 to 25 percent compared to the past.

It’s not just a blip—this is across the board. Rising costs and fewer shoppers make it hard to stay in the black, and only the biggest players seem to catch any real break.

European support funds? Well, they help, but mostly if you’re a big company. The little guys? Not so much.

So, even if the headlines talk about economic recovery, the reality for most retailers is a lot grimmer than it looks on paper.

Tourism used to give shops a boost, but now that’s unpredictable. If visitors don’t spend, shops can’t recover. Simple as that.

Infrastructure is another piece of the puzzle. Towns with good roads, nice facilities, and modern commercial spaces do better. Others, not so much—they’re left behind, struggling to keep up.

Key factors impacting retail revenue in 2025:

Factor |

Impact on Retail Revenue |

|---|---|

Economic environment |

High cost pressures, lower demand |

Unequal EU fund access |

Benefits few large businesses |

Tourism fluctuations |

Variable income in tourist areas |

Infrastructure quality |

Affects regional retail success |

Retailers are stuck in a tough spot. Without better support and fairer growth, the sector’s losses might just keep piling up.

Revenues Drop, But Expenses Rise

Tourism businesses are in a bind: income’s down, but costs just keep climbing. At the end of the season, profits will probably look pretty bleak.

Wages are up, energy is expensive, and food and drink prices are climbing. It’s a rough combo for anyone in hospitality.

Cost Factor |

Impact |

|---|---|

Wages |

Increasing staff salaries raise overall costs. |

Energy |

Higher electricity and heating costs strain budgets. |

Food and Beverage |

Rising prices increase the cost of meals and supplies. |

Restaurants and hotels are especially exposed. Every day, they’re hit with higher bills—food, wages, utilities. Margins shrink, and there’s only so much they can charge before customers walk away.

Hotels have to pay more for staff and energy—heating, cooling, cleaning, all of it. But with so much competition and price-sensitive guests, they can’t just pass those costs on.

So, even when prices go up a bit, the number of sales drops. People pick cheaper options, or simply skip the extras, and businesses see less turnover.

Smaller places feel this even more. They don’t have the cash reserves to ride out bad months or invest in upgrades, making them more vulnerable. The big chains? They’re not immune, but they have a little more room to maneuver.

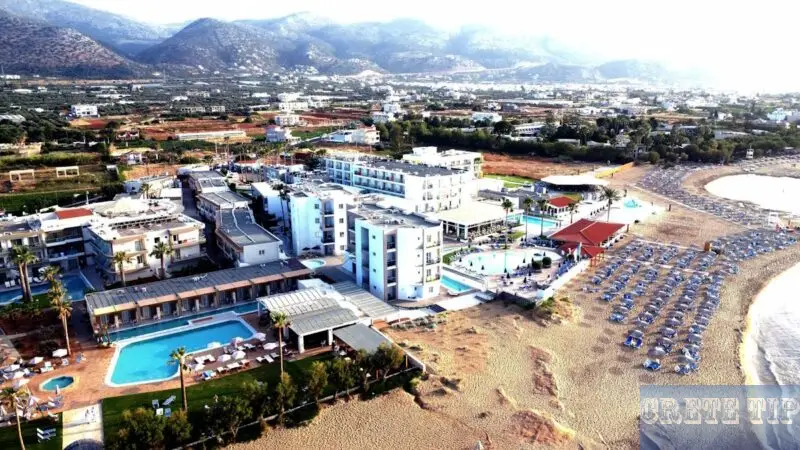

Hoteliers concerned about low occupancy rates in Crete

Even though it’s officially high season, hotel occupancy rates in Crete are stuck at around 50%. That’s pretty surprising given the crowds at airports like “Nikos Kazantzakis” and “Daskalogiannis.”

What’s happening? Many visitors are skipping traditional hotels for cheaper Airbnbs or even unregistered rentals. There’s a lot of informal property renting—about 15,000 cases in Crete, if you believe the estimates.

Hoteliers are hoping for a rush of last-minute bookings, but it probably won’t be enough to fill the gap. The drop in tourism revenue mirrors the broader economic unease shaking Europe.

More guests are coming from the Balkans and Eastern Europe, but they just don’t spend like the big-spending Western Europeans used to. Even those from wealthier countries are tightening their belts this year.

Meanwhile, operating costs for hotels have shot up. Staff wages are 45% higher, energy costs have jumped 60%. Guess who ends up paying for that? Yep, the guests—at least, the ones who still show up.

Still, hoteliers in Crete, especially around Heraklion, aren’t giving up on quality. They refuse to drop their standards just to compete with bargain-basement destinations. Reviews are still good, so that’s something.

Key Issues |

Details |

|---|---|

Occupancy Rate |

Around 50% during high season |

Visitor Preferences |

Shift to Airbnb and informal rentals |

Economic Impact |

Lower spending from Eastern European guests and reduced spending by traditional markets |

Cost Increases |

+45% workforce, +60% energy prices |

Response by Hoteliers |

Maintaining service quality despite pressure |

It’s a tough balancing act: keeping standards high, adapting to new traveler habits, and dealing with rising costs all at once. No easy answers here.

Airbnb Blames Hotels for Overtourism in Europe

Airbnb says hotels are mostly to blame for overtourism in European cities. The company rejects the idea that short-term rental platforms are the main culprits behind overcrowding in tourist hotspots.

They argue that much of the criticism from regulators and locals is pointed in the wrong direction. According to Airbnb, they’re getting an unfair share of the blame.

The vice president of public policy at Airbnb has called out local authorities, especially in places like Barcelona, for targeting short-term rentals. These actions come as public protests against the surge in international travel have grown since the pandemic.

Airbnb insists hotels play a bigger role in overtourism, especially in city centres. It’s a familiar refrain, but they seem pretty adamant about it.

Some numbers from the European Union back up their point: 63% of overnight stays in Europe happen in hotels. In 2024 alone, hotels saw almost 1.9 billion overnight stays—up by 73 million from last year.

Meanwhile, platforms like Airbnb reached 715 million overnight stays, which is a jump of 57 million compared to 2023. So, hotels are still the go-to for most travelers.

Still, governments keep rolling out new policies to curb the impact of short-term rentals. Airbnb says these efforts are frustrating, arguing that politicians often ignore the data when writing new rules.

They believe short-term rentals actually help by spreading visitors out, easing the pressure on the busiest tourist hubs. It’s a bit of a tough sell, but that’s their stance.

Not everyone sees it that way, though. Some experts push back, noting that hotels are usually packed into famous tourist areas, drawing crowds to those spots.

Short-term rentals, on the other hand, are sprinkled throughout entire cities—even deep into residential neighborhoods. That can mean noisier nights, higher rents, and more crowded public transport for locals.

Factor |

Hotels |

Short-term Rentals |

|---|---|---|

Location |

Mainly in central tourist districts |

Spread widely across cities |

Overnight stays (2024) |

1.9 billion (63% of total) |

715 million |

Rate of increase vs 2023 |

+73 million |

+57 million |

Impact on housing |

Concentrated, affects housing market less |

Increases housing prices broadly |

Influence on local life |

Limited to tourist zones |

Affects wider community areas |

Airbnb claims it offers a way to spread tourists out and take the edge off peak congestion. They also mention that short-term rentals can give a boost to local economies that aren’t usually on the tourist trail.

With criticism mounting, local governments have started tightening regulations on short-term rentals. We’re seeing more limits on rental days, tougher licensing, and stricter enforcement to protect residents and keep housing available.

Whether hotels or short-term rentals are the bigger problem? That’s still up for debate. Airbnb keeps pointing to hotels as the main driver, while critics focus on the ripple effects of rentals in everyday neighborhoods.