The History of Crete in the Late 20th Century and the Beginning of the 21st Century (Part 8).

Crete’s recent history

Crete, the largest Greek island, has a rich history spanning millennia, but its journey through the 21st century has been marked by both challenges and opportunities.

In the early 21st century, Crete became a major tourist destination, attracting visitors with its diverse cultures and strategic location at the crossroads of Africa, Europe, and Asia. The island’s economy heavily relies on tourism, agriculture, and services.

However, like the rest of Greece, Crete faced significant economic challenges during the Greek government-debt crisis that began in 2009. This period saw increased unemployment and economic hardship for many residents.

Despite these challenges, Crete has been working to diversify its economy and capitalize on its natural resources. The island has been investing in renewable energy projects, particularly wind and solar power, to reduce dependence on fossil fuels and create new job opportunities.

Crete has also been focusing on sustainable tourism initiatives, aiming to preserve its natural beauty and cultural heritage while still welcoming visitors. This includes promoting eco-friendly accommodations and encouraging exploration of lesser-known parts of the island to distribute tourist impact more evenly.

In recent years, Crete has been gaining recognition for its culinary scene, with its Mediterranean diet and local products gaining popularity worldwide. This has led to an increase in gastronomic tourism and the promotion of Cretan cuisine internationally.

The island has also been working on improving its infrastructure, including the construction of a new international airport for Heraklion, which is set to replace the current one and is expected to significantly boost tourism capacity.

As of 2024, Crete continues to face challenges such as managing the effects of climate change, balancing tourism growth with environmental preservation, and addressing economic disparities. However, the island’s rich cultural heritage, natural beauty, and strategic location continue to position it as an important player in the Mediterranean region.

Crete on the way into the 21st century

In the late 1980s and early 1990s, Crete, like Greece and the European Economic Area, faced an economic downturn. This led to a split between state employees – of whom Greece had a plus of two-thirds in relation to its inhabitants, more than in any other EU state – and the conservative government in Athens, which wanted to impose an austerity programme to cut public spending.

The ensuing strikes and mass protests ended with the crushing defeat of Nea Dimokratia in the October 1993 parliamentary elections and the return to power of a PASOK government still led by the ageing and ailing Andreas Papandreou.

The austerity programme was halted, but as Papandreou’s health deteriorated, he reluctantly resigned in January 1996 and was replaced as head of government by the unimaginative technocrat Kostas Simitis.

Two important events occurred during Simitis’ tenure: Greece’s entry into the EU currency (the euro replaced the drachma in 2002) and the designation of Athens as the venue for the 2004 Olympic Games.

As a result of the latter decision, enormous financial resources flowed into the country and some of the EU’s largest infrastructure projects were launched, catapulting much of the country’s transport system straight into the twenty-first century with new railways, roads and airports (such as the one at Sitia in eastern Crete).

In addition, the Greek national football team under its German coach Otto Rehagel became European champions for the first time in the same year, which was also the trigger for the author of this page to be whisked away to Crete and the southernmost and warmest European island instead of first looking around Sicily or southern Italy.

Crete at the beginning of the 21st century

Despite another narrow electoral victory in 2000, the political tide was turning against PASOK and, lacking a majority, the government was unable to decisively address one of the major problems facing the Greek economy. The trade unions wanted to maintain the status quo, while the business lobby was convinced that the state finances were once again in danger of going out of control.

In the second half of 2003, a stagnant economy and a series of corruption scandals involving PASOK ministers led to a surge in support for Costas Karamanlis, the leader of Nea Dimokratia – and equally the nephew and namesake of the 1970s prime minister – who overtook Simitis in the opinion polls for the first time.

Facing almost certain defeat in the upcoming elections in spring 2004, the powerful leaders in PASOK urged Simitis to resign in favour of Foreign Minister Yiorgos (George) Papandreou, the biological son of the party founder. American-born, Swedish- and British-educated, outgoing, innovative and soft-spoken Papandreou gave the party new hope.

Papandreou’s charisma was not enough to destabilize Nea Dimokratia, however – in a decisive election victory, ND leader Costas Karamanlis became Greece’s youngest ever prime minister at 47. Despite a nationwide shift to the right, Crete once again remained loyal to PASOK: the socialist party received forty percent more votes than its ND rival across the island.

The Karamanlis government proved even less successful than its predecessors in dealing with the ailing economy and rising unemployment. Despite industrial action by the unions during much of 2006 and 2007 against labour and pension reforms, Karamanlis called and won new elections in the autumn of 2007.

However, his party now had only a two-seat lead over PASOK, and it was clear that it would be difficult to impose the authority of the government. As a result, the ND government lurched from one crisis to the next.

A series of corruption scandals, which seemed to reach into the government, rocked the government and in late 2008 riots broke out across the country, ostensibly against a police shooting. However, the real cause of the nationwide protest was the impact of the global economic downturn and frustration with the severely limited prospects for young people.

In September 2009, with the government barely able to hold on to power, Karamanlis again called new elections. Voters punished ND and handed victory to PASOK and its leader George Papandreou. The traditional ND electorate seemed to be more interested in punishing Karamanlis than in being convinced by Papandreou’s vague promises. The party achieved its worst election result ever.

By repeatedly using buzzwords like ‘competitiveness’, ‘fight against climate change’ and ‘electronic bureaucracy’, Papandreou tried to project a modern image, in contrast to the more cranky ND leadership.

Already in 2007, there were severe forest fires in Greece and also on Crete, as the following photo shows. Due to the ongoing climate change, which in recent decades has led to less rainfall in winter and more drought in summer, Greece has been hit by such disasters more and more frequently.

Crete in the greatest crisis

The new government has no chance of dealing with Greece’s ongoing problems and was overwhelmed by the financial tsunami of the sovereign debt crisis that hit the country in late 2009. Reports that Greece was using dubious accounting practices to conceal the extent of its debt caused panic among foreign investors, who feared that the country would not be able to service its debt.

After numerous revisions of the debt figures, the Greek deficit was revised upwards again in May 2010, to an estimated 15 percent of GDP – with a permissible limit of three percent in the euro area. This left Greece with one of the highest debt levels in the world.

The rating agencies then downgraded Greek government bonds to junk status, triggering further panic in the financial markets. In order to avert a default by the Greek government, the EU and the IMF put together an inevitable €45 billion bailout package in May 2010, to be followed by another €65 billion.

The price for this funding was a series of harsh austerity measures to bring the government’s deficit under control. These measures, consisting of staff cuts and salary reductions in the public sector as well as labour and pension reforms, were rejected by large parts of the Greek population and a wave of social unrest swept across the country. Strikes and riots broke out in Athens and other cities.

Throughout 2011, the Papandreou government tried to cope with the crisis and introduced further austerity measures, further sinking its popularity. In November, having failed to win the support of the other major parties to form a coalition, Papandreou resigned as prime minister.

The PASOK and Nea Dimokratia parties agreed to form an interim government led by Lucas Papademos, Vice-President of the European Central Bank, until new elections could be held.

In May 2012, the country went to the polls, but the result was a stalemate: no party was able to form a government. New elections were held on 17 June, with politicians urging voters to vote responsibly to save the country.

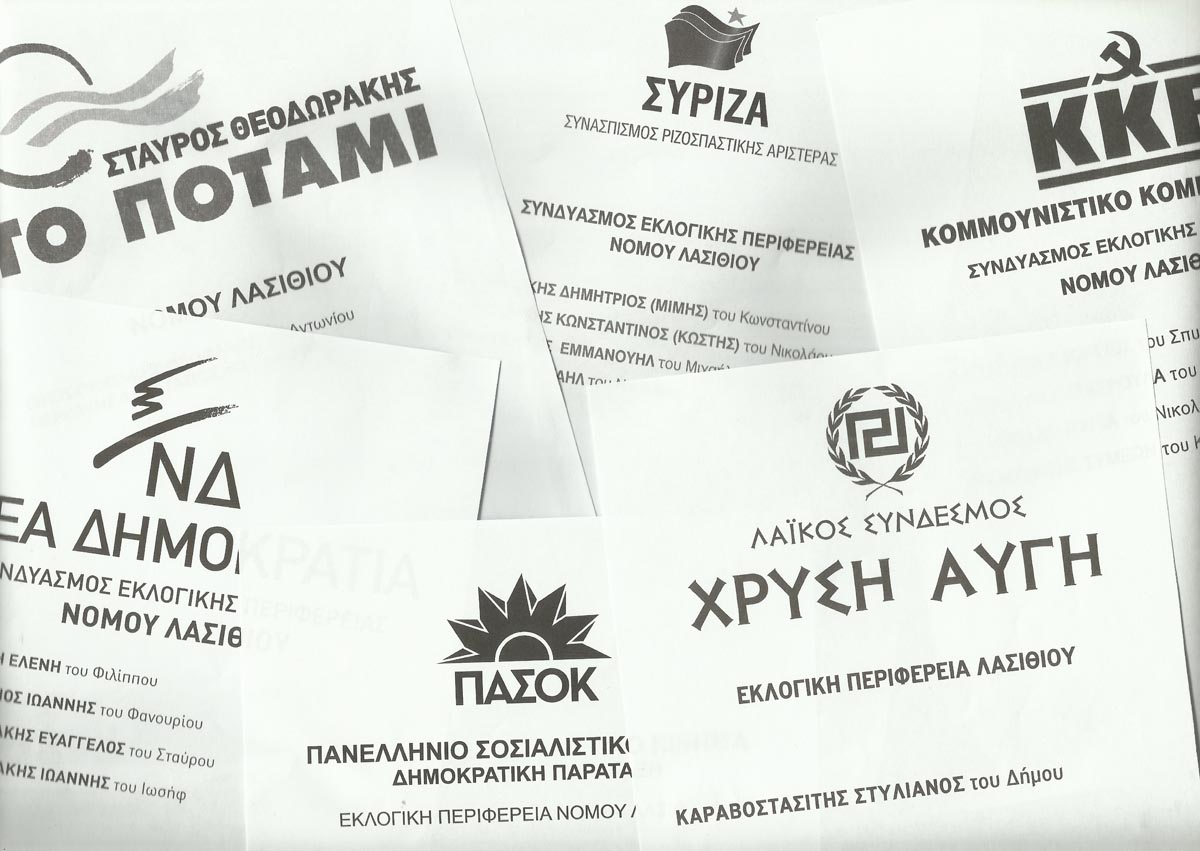

ND under its leader Antonis Samaras won the most seats and formed a grand coalition with PASOK under its new leader, Evangelos Venizélos, on 20 June. The new coalition government had a viable majority over the other opposition parties – but, worryingly for the future, it included far-left and neo-Nazi groups who wanted to resist the ‘foreign-imposed’ financial restrictions.

At the end of 2012, Greece was still in recession, while further austerity measures were introduced to obtain more bailouts from the EU, without which the government would not be able to pay public sector pensions and salaries. Many financial experts were convinced that Greece would have to leave the eurozone and devalue if it wanted to save itself from ruin. But leaving the eurozone is by no means risk-free and would have thrown the Greek banking system into chaos.

How did Greece and the EU get into this mess in the first place? For the cause, we have to look back to 2001, when Greece adopted the euro as its currency. Greece had been a member of the EU since 1981, but should not have been admitted to the Eurozone because its budget deficit was too high for the Eurozone’s Maastricht criteria.

In the first few years, everything went well. Like other eurozone countries, Greece benefited from the power of the euro, which depressed interest rates and attracted investment capital and credit.

It was not until 2004 that the Greek government officially admitted that the country had cheated to avoid the Maastricht criteria. As a result, the EU did not impose sanctions!

There were three reasons for this: the two largest economies in the euro area – France and Germany – were also spending more money than allowed at the time. It would have been hypocritical to sanction Greece before they had implemented their own austerity measures.

Furthermore, there was confusion about exactly what sanctions should be imposed. Greece could have been excluded, but that would have led to turbulence and weakened the euro. However, the EU did not want this to happen, as it wanted to strengthen the power of the euro on the international currency markets in order to convince other EU countries such as the UK, Denmark and Sweden to adopt the euro.

As a result, Greek debt continued to rise until the outbreak of the crisis in 2008.

In September 2012, trade unions called a 24-hour general strike against the government’s austerity measures. Police used tear gas to break up an anarchist rally in front of parliament.

In October 2012, parliament passes a 13.5 billion euro austerity plan to secure the next round of EU and IMF bailout loans. The package – the fourth in three years – includes tax increases and pension cuts.

Also in 2012, a Greek animal welfare law was passed for the first time as part of an EU regulation that was supposed to restrict the keeping of chain and barrel dogs, which often languish in catastrophic conditions. However, as the law left too many loopholes in practice and ‘permanent chaining’ was difficult to prove, it was recently revised and improved by the Greek Animal Welfare Law 4830/2021.

By January 2013, unemployment had risen to 26.8 %, the highest in the EU. By April, youth unemployment had climbed to almost 60 % and the public broadcaster had to be closed.

In June 2013, the government shut down the state broadcaster ERT to save money. Two months later, a new state broadcaster EDT was established.

In September 2013, the government cracked down on the far-right party ‘Golden Dawn’. Party leader Nikolaos Michaloliakos and five other Golden Dawn MPs are arrested on charges including assault, money laundering and membership of a criminal organisation.

in December 2013, parliament passed the 2014 budget, which envisaged a return to growth after six years of recession. Prime Minister Samaras welcomed this as the first decisive step towards exiting the bailout programme.

In February 2014, unemployment rose to a record high of 28 %. In March, the parliament narrowly approved a comprehensive reform package that opened more retail sectors to competition and was part of an agreement between Greece and its international lenders.

In April 2014, eurozone finance ministers said they would provide Greece with an additional €8 billion in aid.

Greece raised nearly $4 billion on the international financial markets in its first sale of long-term government bonds in four years, taking an important step towards the country’s economic recovery.

In May 2014, the radical left Syriza alliance nevertheless won the European election with 26.6% of the vote in Greece.

Then, in December 2014, the parliament failed to elect a new president. This triggered a political crisis and led to early elections.

In February, the new left-wing government negotiated, sometimes chaotically, a four-month extension of the bailout programme for Greece in exchange for foregoing key austerity measures and promising to implement a Eurozone-approved reform programme.

In June and July, the European Central Bank finally ended the emergency funding. Greece closed its banks and imposed capital controls. Voters overwhelmingly rejected the terms of the EU bailout programme in a referendum (‘Ochi-Oxi’) in July.

Nevertheless, in August 2015 Greece and its creditors agreed on a third bailout package worth 86 billion euros, which imposed further spending cuts on the country to avoid bankruptcy and exit from the eurozone.

As of February 2018, the rating agency Fitch raised its rating on Greece due to its growing economy and increasing political stability. In June, Macedonia and Greece signed a historic agreement to settle the 27-year dispute over Macedonia’s official name.

In July 2019, the new centre-right party Neo Dimokratia won early elections in a landslide, and its leader Kyriakos Mitsotakis, who incidentally hails from Crete, became prime minister.

His time in office is overshadowed by the outbreak of the Corona crisis, which delivers another severe shock to Crete’s newly recovering economy, which is heavily dependent on tourism.

COVID-19 pandemic: Like many other countries, Greece faced significant challenges due to the global pandemic, which impacted the country’s economy and the important tourism sector in particular.

Economic recovery: Greece continued its efforts to recover from the debt crisis that began in 2009. By 2021, Greece was officially released from the enhanced surveillance framework imposed by the European Union, marking an important milestone in the country’s economic recovery.

Migration challenges: Greece continued to struggle with migration issues, as it is a major entry point for refugees and migrants seeking to enter the European Union.

Diplomatic tensions: Greece experiences ongoing tensions with Turkey over territorial disputes in the Eastern Mediterranean, including issues related to maritime borders and energy exploration rights.

Climate change: The country is facing increasing challenges related to climate change, including more frequent and intense heat waves and forest fires.

Political developments: Greece held parliamentary elections in 2023, from which the New Democracy party led by Kyriakos Mitsotakis again emerged victorious.

It is important to note that Greece, as a member of the European Union since 1981, continued to play a role in EU affairs and policies during this period.